Strong momentum in Q4 - Improved operations despite market headwinds

09.02.2026

The Bakkafrost Group delivered a total operational EBIT of DKK 295 million (DKK 280 million) in Q4 2025.

(Figures in parenthesis refer to the same period last year unless otherwise specified)

The performance in Q4 2025 per region was as follows:

· Faroe Islands Revenues of DKK 1,544 million (1,184 million)

Operational EBIT of DKK 392 million (310 million)

· Scotland Revenues of DKK 303 million (286 million)

Operational EBIT of DKK -97 million (-31 million)

Commenting on the result, CEO Regin Jacobsen said:

“Operationally, the Group delivered a solid performance in the fourth quarter, driven by strong biological development in the Faroe Islands where biomass levels reached an all-time high. This supports improved cost efficiency and operational robustness, which remains a key priority across the Group.

In Scotland, we are pleased to see continued progress from the ramp-up at our Applecross hatchery. Production volumes of large, high-quality smolt are increasing, making Applecross a cornerstone in our Scottish operations. We remain firmly focused on a steady and controlled ramp-up, prioritising biological stability and predictable execution.

The improved operational performance is encouraging as we look towards 2026. Following a period of elevated global supply growth in 2025, the market environment improved towards the end of the fourth quarter, and we expect the salmon market to be even tighter from Q2 2026 and onwards.

However, the financial results in the fourth quarter were not satisfactory, as they were impacted by the continued high global supply of salmon, which negatively affected market prices for the majority of the quarter. Additionally, the Scottish operations were impacted in October by the harvesting and emptying of the Portree farming site following the exceptional mortality event previously reported in the Q3 interim report.

Despite these headwinds, Bakkafrost remains focused on cost discipline, biological control, and operational stability. We will continue to execute on our strategic investments while maintaining a prudent and steady approach to growth to support long-term sustainable value creation.”

During Q4 2025, the FOF segment sourced 39,826 tonnes (41,919 tonnes) of raw material. The Operational EBIT margin was 10% (12%), and fish feed sales amounted to 47,216 tonnes (38,853 tonnes).

For the full year of 2025, the FOF segment's operational EBIT margin was 12% (18%). For the full year of 2025, Havsbrún sourced 349,219 tonnes (309,502 tonnes) of raw material.

In Q4 2025, the Freshwater segments in the Faroe Islands and Scotland transferred a total of 7.5 million (7.1 million) smolts combined:

· Freshwater FO: 5.3 million (6.1 million),

· Freshwater SCT: 2.2 million (1.0 million).

In 2025, the freshwater segments have released a total of 26.1 million (23.1 million) smolts:

· Freshwater FO: 18.7 million (17.1 million),

· Freshwater SCT: 7.3 million (6.0 million).

In Q4 2025, the Freshwater FO segment made an operational EBIT per kg transferred smolt of DKK 39.63 (DKK 43.52), corresponding to NOK 62.35 (NOK 68.59). The Freshwater SCT segment made an operational EBIT per kg transferred smolt of DKK -11.74 (DKK -181.48), corresponding to NOK -18.46 (NOK -286.01). In Q4 2025, the Freshwater SCT segment had incident-based costs of DKK 3 million.

The Farming segments achieved lower prices in Q4 2025 than in Q4 2024. The Farming segments had higher volumes in Q4 2025 compared to Q4 2024. In Q4 2025, the Farming SCT segment had incident-based costs of DKK 55 million (DKK 19 million).

The total combined harvest in Q4 2025 of the farming segments in the Faroe Islands and Scotland was 27,891 tonnes gutted weight (20,478 tgw):

· Farming FO: 23,312 tgw (16,638 tgw),

· Farming SCT: 4,579 tgw (3,840 tgw).

For the full year 2025, the farming segments harvested a total of 106,823 tonnes gutted weight (90,656):

· Farming FO: 83,638 tgw (62,776 tgw),

· Farming SCT: 23,185 tgw (27,880 tgw).

In Q4 2025, the Farming FO segment made an operational EBIT per kg of DKK 7.34 (DKK 5.98), corresponding to NOK 11.55 (NOK 9.43). The Farming SCT segment made an operational EBIT per kg of DKK -23.92 (DKK -14.44), corresponding to NOK -37.62 (NOK -22.76).

The Services segment made an operational EBIT per kg of DKK 1.11 (DKK 1.23), corresponding to NOK 1.75 (NOK 1.93). The operational EBIT margin for the segment was 13% (13%).

The Sales & Other segment had a revenue of DKK 2,792 million (2,293 million) and an operational EBIT margin of 3% (5%). The operational EBIT per kg was DKK 2.76 (DKK 5.88), corresponding to NOK 4.35 (NOK 9.26).

The performance related to the Faroe Islands and Scotland as a region can be found in the Appendix A in the 2025 Q4 Interim Report.

The long-term goal of the Board of Directors is that 30-50% of earnings per share shall be paid out as a dividend. Bakkafrost’s financial position is strong, with a solid balance sheet, a competitive operation, and available credit facilities. The Board of Directors proposes to the Annual General Meeting that DKK 3.45 (NOK 5.27*) per share shall be paid out as dividend. The Annual General Meeting will be convened on Thursday 30th of April 2026.

* The dividend per share in NOK is subject to changes depending on the exchange rate between NOK and DKK, which will be announced after the Annual General Meeting

OUTLOOK AND OPERATIONAL PERFORMANCE

Market

Substantially increased supply in Q4 2025

The supply of salmon increased 7.5% in Q4 2025 compared to Q4 2024, incl. inventory movements. Without inventory movements, the supply increase was 9.0%, according to the latest estimate from Kontali Analyse.

Higher salmon prices in Q4 2025

Salmon reference prices (in NOK) for 4-5kg superior salmon were 29% higher this quarter compared to Q4 2024. The price increase was driven by good demand and supply easing off towards the end of the quarter.

2% growth in 2026

The global supply is expected to increase around 4% in H1 2026. In H2 2026, the global supply is expected to reduce around 1%, compared to H2 2025. For the full year 2026, the global supply is expected grow around 2%, excluding inventory movements.

Bakkafrost has a strong focus on ensuring a well-balanced flow to the different markets to increase diversification and mitigate market risk. Bakkafrost operates in the main salmon markets, Europe, the USA, and the Far East. Since the beginning of the war in Ukraine, Bakkafrost has stopped all trading with Russia.

Operations

Farming Faroe Islands

The Faroese farming operations delivered continued strong growth and biological performance during the quarter. Sea lice levels remained well controlled by the very efficient dual-freshwater treatment strategy. Mortality rates were very low in the quarter, reflecting robust fish health and favourable farming conditions. As a result of increasing stocking of large high-quality smolt, strong growth and high survivability, the biomass at sea reached the highest level recorded at year-end, providing a solid foundation for future harvest volumes.

Freshwater Faroe Islands

Q4 2025 concluded a record-breaking year for the Faroese freshwater operations across all key parameters, including smolt numbers, biomass in hatcheries, average smolt size and mortality levels. Performance in the hatcheries remained strong throughout the year, with low mortality both during production but also following transfer to the marine phase, which is a strong indicator of high quality and robust smolt. The high biomass currently in the freshwater pipeline provides a strong biological foundation for 2026 and supports continued stability and growth in the marine operations.

Construction of the new hatchery in Skálavík is progressing according to plan. The facility is expected to commence operations with first egg intake in Q2 2026, followed by initial smolt output towards the end of 2027. Upon completion, total smolt production capacity in the Faroe Islands is expected to increase to approximately 24.4 million smolt at 500g, up from the current level of around 18 million. The new hatchery will strengthen long-term smolt supply, enhance biological control, and support continued operational robustness in the Faroese value chain.

Farming Scotland

The Scottish farming operations delivered generally stable biological performance during the quarter, with large fish harvested across most sites. Performance was impacted in October following the Pasteurella outbreak at the Portree farming site in September, as previously reported in the Q3 interim report. The site was subsequently harvested and emptied during October, resulting in elevated mortality and lower average harvest weights in that month.

Excluding the Portree site, biological performance across the remaining Scottish farming sites continued to improve through the quarter. Mortality rates in November and December were below the average levels observed over the past five years, while harvest weights remained strong. Overall, the quarter reflects continued progress in strengthening and stabilising the Scottish marine operations.

During 2026, the biomass at sea will gradually change character, transitioning to be based on large and high-quality smolt. This strategic shift is expected to enhance overall fish health and growth rates, leading to a more robust and sustainable aquaculture environment.

Freshwater Scotland

The Scottish freshwater operation continues its ramp-up, with Applecross established as the cornerstone of Bakkafrost’s strategy to produce large, high-quality smolt in Scotland, with a production capacity of approximately 3,500 tonnes. Since August, operational stability at Applecross has improved, enabling a gradual increase in the output of larger, high-quality smolt. The continued ramp-up at Applecross remains a central element in strengthening biological performance and reducing operational risk in the Scottish farming operations over time.

Applecross will produce smolt with an average weight between 200g to 400g. This allows for good flexibility in production planning, better utilisation of capacity, and improved biological outcomes.

In Q4 2025, the average weight of transferred smolt from Applecross in Scotland was 173g, which is 4% higher than in Q4 2024. The average smolt weight for all Bakkafrost’s smolt release in Scotland in the quarter was 142g, which is -7% lower than in Q4 2024.

Services

The smolt transfer system supporting the Scottish operations has undergone a significant upgrade. The farming service vessel Bakkanes has been rebuilt to handle smolt transfers and now operates in line with the proven solution implemented on its sister vessel Martin in the Faroe Islands. The upgraded system represents a clear step forward in ensuring safe and efficient smolt transfers, reducing stress and mortality during transfer operations and strengthening overall operational reliability across the Scottish farming sites. These improvements further support the development of a robust, efficient and sustainable Scottish farming platform going forward.

Smolt transfer

Bakkafrost’s expected smolt transfer in 2026 in the Faroe Islands is around 20.0 million smolts with an average weight of around 440g. In Scotland, the smolt transfer in 2026 is expected to be around 10.0 million smolt with an average weight of 179g. This includes internally produced smolt as well as externally sourced. The number and average weight of smolts transferred are key elements of predicting Bakkafrost’s future production.

Million smolt transferred | ‘26e | ‘25 | ‘24 | ‘23 | ‘22 | ‘21 |

FO | 20.0 | 18.7 | 17.1 | 14.2 | 14.4 | 14.4 |

SCT | 10.0 | 7.3 | 6.0 | 9.0 | 11.0 | 11.1 |

Avg. weight (g) |

|

|

|

|

|

|

FO | 440 | 453 | 410 | 396 | 345 | 376 |

SCT | 179 | 154 | 109 | 117 | 107 | 95 |

In 2026, Bakkafrost expects to harvest around 92,000 tonnes gutted weight in the Faroe Islands and around 20,000 tonnes in Scotland, giving at total of around 112,000 tonnes gutted weight. The quarterly harvest profile is outlined in in the table below. Biological, environmental and market conditions can affect the expected harvest profile.

Expected harvest profile in 2026 as a % of total harvest pr. region:

Region | Q1 | Q2 | Q3 | Q4 |

FO | 23% | 25% | 26% | 26% |

SCT | 30% | 14% | 18% | 38% |

The estimates for harvest volumes and smolt transfers in both geographies are dependent on biological development.

Sales & VAP (Value added products)

Bakkafrost's highly flexible value chain includes state-of-the-art VAP processing capacity, which enables the company to adapt effectively to rapidly changing market situations.

As a result of changes in the Faroese revenue tax, Bakkafrost has adjusted the strategy for contracted VAP (Value-Added Products) to reduce contract exposure.

For 2026, Bakkafrost intends to sign contracts covering around 15-20% of the expected harvest volumes in the Faroe Islands and Scotland combined.

FOF (Fishmeal, oil and feed)

The outlook of fishmeal and fish oil production is dependent on the availability of raw materials.

The ICES 2026 recommendation for blue whiting is 851 thousand tonnes, which represents a 41.2% decrease from the recommendation for 2025.

In 2026 Bakkafrost expects lower production volumes of fishmeal and fish oil as in 2025.

Bakkafrost expects the feed production at Havsbrún to be around 165,000 tonnes in 2026. Close to all of this will be sold internally to Bakkafrost’s Faroese and Scottish Farming segments.

Investments

On the Capital Markets Day on 17-18 June 2025, Bakkafrost announced a 5.0bn DKK investment plan for 2026-2030. The main purpose is to improve efficiency, reduce biological risk and enable continued sustainable growth in the Faroe Islands and Scotland.

The investments in the Faroe Islands will increase the annual smolt production capacity to 24.4 million smolt of 500g. The feed production capacity and flexibility are also increased to further improve R&D capabilities and meet the growing demand for feed as harvest volumes increase in the Faroe Islands and Scotland. Also, investments in new farming sites and new farming technology are included, as well as investments to improve harvest capacity and flexibility with Live Fish Holding Tanks.

In Scotland, planned investments include site expansions and optimisation as well as building a new harvest and processing facility to accommodate the growing harvest volume.

As a shared service to the Group, the investment plan includes building 2 new dual-freshwater treatment vessels in the FSV segment.

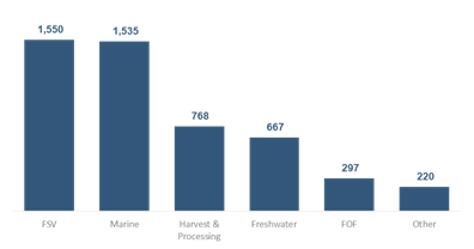

2026-2030 Investment programme per category (DKK 1,000)

Incorporated into the investment plan is also 245mDKK earmarked to energy transition, spread across the value chain.

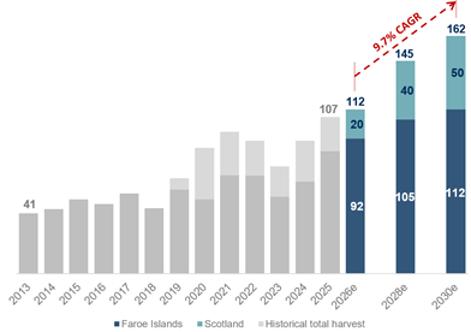

With the investment plan, Bakkafrost expects to sustainably grow the total annual harvest volumes to 162,000 tonnes in 2030.

Harvest volume (kilotonnes)

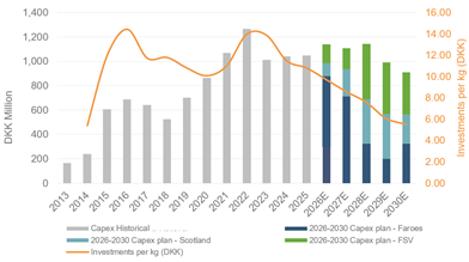

Since the announcement of the 2026-2030 investment plan on the CMD in 2025, Bakkafrost has decided to let some of the investments planned for 2025 rollover into 2026 due to the weak market outlook for 2025. Consequently, the timing of other investments in the announced 2026-2030 plan have been adjusted.

Updated 2026-2030 5.0bn DKK Investment programme vs. historical investments (DKK 1,000)

Financial

The global salmon product market's long-term balance is likely to favour Bakkafrost. Bakkafrost has a long value chain and a cost-efficient production of high-quality salmon products and will likely maintain financial flexibility going forward.

In March 2022, Bakkafrost secured a 700 mEUR sustainability-linked credit facility (expandable by 150 mEUR) with a 5-year term and 2-year extension options which have been executed. This facility, along with Bakkafrost's strong equity ratio, bolsters the Group's financial strength for organic growth and cost reduction in Scotland, while also facilitating M&A and future organic growth opportunities, and upholding an unchanged dividend policy.

Please find the Company’s Q4 2025 report and the Q4 2025 presentation enclosed.

Contacts:

· Regin Jacobsen, CEO of P/F Bakkafrost: +298 235001 (mobile)

· Høgni Dahl Jakobsen, CFO of P/F Bakkafrost: +298 235060 (mobile)

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

About Bakkafrost:

Bakkafrost is the largest salmon farmer in the Faroe Islands and the second-largest salmon farmer in Scotland. The Group is fully integrated from feed production to smolt, farming, VAP and sales. The Group has production of fishmeal, fish oil and salmon feed in the Faroe Islands and primary and secondary processing in the Faroe Islands, Scotland and Denmark. The Group operates sea farming and broodstock operations in both the Faroe Islands and Scotland. The Group has built a biogas plant in the Faroe Islands. The headquarter is located in the Faroe Islands, and the Group has sales and administration offices in Edinburgh (Scotland), Boulogne-Sur-Mer (France), New Jersey (US) and Munkebo (DK). The Bakkafrost Group has 1,686 employees (full-time equivalents).

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities. The securities referred to herein may not be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended. Copies of this announcement are not being made and may not be distributed or sent into the United States, Australia, Canada or Japan.