Strong biological performance in a weak market

26.08.2025

The Bakkafrost Group delivered a total operational EBIT of DKK 65 million (DKK 388 million) in Q2 2025.

(Figures in parenthesis refer to the same period last year unless otherwise specified)

The performance in Q2 2025 per region was as follows:

- Faroe Islands

- Revenues of DKK 1,144 million (1,187 million)

- Operational EBIT of DKK 211 million (275 million)

- Scotland

- Revenues of DKK 431 million (880 million)

- Operational EBIT of DKK -146 million (113 million)

Commenting on the result, CEO Regin Jacobsen said:

“We are not satisfied with the financial results in this quarter. A significant increase in global salmon supply has led to low salmon prices, impacting our earnings.

At the same time, we are very pleased with the achieved cost reduction in the Faroes, highlighted by a 12% reduction in our farming costs, and we continue to prioritize cost discipline also going forward.

In the Faroe Islands, biological performance reached the highest level ever recorded for the company, which we view as a very strong achievement. The farming segment delivered exceptionally strong biological performance in the quarter, with robust growth and survival rates at the best level seen in more than a decade. Feeding activity reached all-time highs, while mortality was reduced by 52% compared to the same quarter last year. In the Faroese freshwater operation, performance has stepped up to a new level – delivering smolt of unprecedented quality and robustness, building a strong foundation for our future farming. This is clearly evidenced by post-transfer survivability at record-high levels.

In Scotland, we are not pleased with the performance in the freshwater operation, where we unfortunately faced significant mortalities due to diseases. To address this, we are integrating the Scottish freshwater operations under the Faroese organisation, led by the Group Freshwater Director, and have strengthened the site management at Applecross with experienced staff from the Faroe Islands. While freshwater remains a challenge, the Scottish marine operations have shown good development overall, although some one-off events led to higher mortality.

Despite the pressure from lower prices, the strong biological performance in both the Faroes and Scotland has supported volume growth. We are therefore increasing our harvest guidance for the year in both regions by a total of 7%. Our strategic priorities remain unchanged – to continue building biological resilience, strengthen operational performance across regions, and secure long-term value creation.”

During Q2 2025, the FOF segment sourced 159,951 tonnes (90,575 tonnes) of raw material. The Operational EBIT margin was 13% (16%), and fish feed sales amounted to 37,533 tonnes (32,949 tonnes).

For H1 2025, the FOF segment's operational EBIT margin was 13% (20%). During H1 2025, Havsbrún sourced 269,453 tonnes (227,449 tonnes) of raw material.

In Q2 2025, the Freshwater segments in the Faroe Islands and Scotland transferred a total of 6.4 million (5.5 million) smolts combined:

- Freshwater FO: 5.4 million (4.0 million),

- Freshwater SCT: 0.9 million (1.5 million).

For H1 2025, the freshwater segments have released a total of 10.1 (9.2) million smolts:

- Freshwater FO: 8.6 million (6.1 million),

- Freshwater SCT: 1.5 million (3.1 million).

In Q2 2025, the Freshwater FO segment made an operational EBIT per kg transferred smolt of DKK 33.30 (DKK 47.23), corresponding to NOK 52.09 (NOK 73.19). The Freshwater SCT segment made an operational EBIT per kg transferred smolt of DKK -464.58 (DKK -218.76), corresponding to NOK -726.77 (NOK -338.99).

The Farming segments achieved lower prices in Q2 2025 than in Q2 2024. The Farming segments had higher volumes in Q2 2025 compared to Q2 2024. In Q2 2025, the Farming SCT segment had incident-based costs of DKK 39 million (DKK 24 million).

The total combined harvest in Q2 2025 of the farming segments in the Faroe Islands and Scotland was 23,054 tonnes gutted weight (21,592 tgw):

- Farming FO: 16,020 tgw (10,226 tgw),

- Farming SCT: 7,034 tgw (11,366 tgw).

For H1 2025, the farming segments have harvested a total of 48,254 tonnes gutted weight (43,149):

- Farming FO: 34,934 tgw (24,520 tgw),

- Farming SCT: 13,320 tgw (18,629 tgw).

In Q2 2025, the Farming FO segment made an operational EBIT per kg of DKK 0.24 (DKK 20.15), corresponding to NOK 0.37 (NOK 31.23). The Farming SCT segment made an operational EBIT per kg of DKK -18.13 (DKK 9.79), corresponding to NOK -28.36 (NOK 15.18).

The Services segment made an operational EBIT per kg of DKK 0.74 (DKK 0.56), corresponding to NOK 1.16 (NOK 0.87). The operational EBIT margin for the segment was 8% (6%).

The Sales & Other segment had a revenue of DKK 2,198 million (2,582 million) and an operational EBIT margin of 4% -2%. The operational EBIT per kg was DKK 4.19 (DKK -2.65), corresponding to NOK 6.55 (NOK -4.10).

The performance related to the Faroe Islands and Scotland as a region can be found in the Appendix.

The long-term goal of the Board of Directors is that 30-50% of earnings per share shall be paid out as a dividend. Bakkafrost’s financial position is strong, with a solid balance sheet, a competitive operation, and available credit facilities. The Annual General Meeting convened on April 30 2025, decided to pay out a dividend of DKK 8.44 (NOK 13.37) per share. The total dividend of DKK 501 million (NOK 781 million) was paid in May 2025.

OUTLOOK AND OPERATIONAL PERFORMANCE

Market

Substantially increased supply in Q2 2025

The supply of salmon increased 16.6% in Q2 2025 compared to Q2 2024, incl. inventory movements. Without inventory movements, the supply increase was 18.1%, according to the latest estimate from Kontali Analyse.

Lower salmon prices in Q2 2025

Salmon reference prices (in NOK) for 4-5kg superior salmon were 33.3% lower this quarter compared to Q2 2024. The price reduction was driven by substantial increase in supply from several regions, most dominantly from Norway following improved biology and strong growth due to higher seawater temperature.

9% growth in 2025

The global supply is expected to increase around 5% in H2 2025, compared to H2 2024. For the full year 2025, the global supply is expected grow around 9%.

In Q2 2025, the salmon market has been strongly affected by the massive supply increase in the quarter, especially from Norway but also from Chile, the Faroe Islands and Iceland. The improved biology in Norway has also increased the share of superior fish sold to the market, consequently leading to a unexpected oversupply to the spot market.

Bakkafrost has a strong focus on ensuring a well-balanced flow to the different markets to increase diversification and mitigate market risk. Bakkafrost operates in the main salmon markets, Europe, the USA, and the Far East. Since the beginning of the war in Ukraine, Bakkafrost has stopped all trading with Russia.

Farming

In Q2 2025, the biological performance in the Faroese farming operation continued to strengthen and reached one of the best positions ever. Sea lice levels were well controlled, and harvest weights have been high, despite one farming site deliberately being harvested early to fit with the production plan and smolt restocking schedule. Feeding volumes have been record-breaking, while growth and survivability rates have increased significantly. Total farming costs continue to trend down from the peek-levels in 2023-2024, driven by the strong biological performance and lower feed costs. Due to strong biological performance, Bakkafrost is increasing it’s Faroese harvest target for 2025 to 82,000 tonnes.

Continuous improvements also characterise the Faroese freshwater operation with increased the production volume of large high-quality smolt. The capacity utilization is growing with increased production volume and downward-trending production costs. The volume is projected to rise in 2025, with smolt weights a bit higher than in 2024. The current hatchery capacity in the Faroes allows for an annual smolt production of 9,000 tonnes, equalling 18 million smolt of 500g. This will increase to 24.4 million smolt of 500g when the ongoing construction of the new hatchery in Skálavík will be finished late 2026. The construction of the hatchery progresses according to plan and the operation is expected to start in Q2 2026. In Q2 2025, the average weight of transferred smolt in the Faroe Islands was 464g, which is 20% higher than in 2024.

In Q2 2025, some Scottish marine farming sites faced disease issues, resulting in higher mortality costs and write-downs until mid-July. However, strong biological performance at other sites led to good harvest weights and growth. As a result, Bakkafrost has raised Scotland’s 2025 harvest target to 22,000 tonnes.

The fish affected by disease in the quarter were “legacy-fish”, representing the reduced smolt quality from the past. During 2025 and into 2026, the biomass at sea will gradually change character, transitioning to be based on large and high-quality smolt. This strategic shift is expected to enhance overall fish health and growth rates, leading to a more robust and sustainable aquaculture environment.

In the Scottish freshwater operation the main focus is to continue the ramp-up of the production of large high-quality smolt from Applecross. This is not a straight-line development, but a delicate and gradual process involving some level of risk which reduces as the operation is fine-tuned, and all procedures executed at least once. While some of the production modules at Applecross display good performance with strong growth and low mortality, disease-driven exceptional mortality was experienced in one of the Applecross modules in this quarter, as reported on 15th July 2025.

Since the previous quarter, the new Applecross 6 module has been commissioned and started operation. The Applecross hatchery now has a production capacity of around 3,500 tonnes of smolt annually, planned to be transferred at weights above 200g.

In Q2 2025, the average weight of transferred smolt from Applecross in Scotland was 232g, which is 80% higher than in Q1 2024. The average smolt weight for all Bakkafrost’s smolt release in Scotland in the quarter was 170g, which is 79% higher than in Q2 2024.

Reorganising the Scottish Freshwater operation under Group Leadership

A secure and steady ramp-up of the Scottish freshwater operation is essential to strengthen overall performance in Scotland. Until now, the Scottish freshwater department has worked closely with its Faroese peer to ensure effective knowledge transfer and alignment on best practices.

To further consolidate this, the two freshwater departments have now been merged under the leadership of the Group Freshwater Director, based in the Faroe Islands. This step ensures a unified approach across geographies and leverages the Group’s extensive experience in freshwater management. At the same time, the local team in Scotland continues to play a central role in daily operations, with site management at Applecross further reinforced through the relocation of experienced colleagues from the Faroes to support and complement the Scottish workforce.

Smolt transfer

Bakkafrost’s expected smolt transfer in 2025 in the Faroe Islands is around 18.5 million smolts with an average weight of around 430g. In Scotland, the smolt transfer plan and smolt production strategy is currently under review by the new Group Freshwater Management. Depending on the conclusions from this review on optimal capacity utilisation and smolt sizes, the smolt transfer for 2025 is expected to be 6-7 million smolt. The number and average weight of smolts transferred are key elements of predicting Bakkafrost’s future production.

Million smolt transferred | ‘25e | ‘24 | ‘23 | ‘22 | ‘21 | ‘20 |

FO | 18.5 | 17.1 | 14.2 | 14.4 | 14.4 | 14.7 |

SCT | 6-7 | 6.0 | 9.0 | 11.0 | 11.1 | 10.4 |

Avg. weight (g) |

|

|

|

|

|

|

FO | 430 | 410 | 396 | 345 | 376 | 320 |

SCT | TBD | 109 | 117 | 107 | 95 | 88 |

For 2025, Bakkafrost increases the expected harvest in the Faroe Islands from 77,000 tonnes to around 82,000 tonnes gutted weight. The expected harvest in Scotland is also increased from 20,000 tonnes to around 22,000 tonnes gutted weight. This gives an increased total harvest in 2025 of around 104,000 tonnes gutted weight. The quarterly harvest profile is outlined in in the table below. Biological, environmental and market conditions can affect the expected harvest profile.

Expected harvest profile in 2025 as a % of total harvest pr. region:

Region | Q1 | Q2 | Q3 | Q4 |

FO | 23% | 20% | 29% | 29% |

SCT | 29% | 32% | 19% | 20% |

The estimates for harvest volumes and smolt transfers in both geographies are dependent on biological development.

Sales & VAP (Value added products)

Bakkafrost's highly flexible value chain includes state-of-the-art VAP processing capacity, which enables the company to adapt effectively to rapidly changing market situations.

As a result of changes in the Faroese revenue tax, Bakkafrost has adjusted the strategy for contracted VAP (Value-Added Products) to reduce contract exposure.

For 2025, Bakkafrost intends to sign contracts covering around 15-20% of the expected harvest volumes in the Faroe Islands and Scotland combined.

FOF (Fishmeal, oil and feed)

The outlook of fishmeal and fish oil production is dependent on the availability of raw materials.

The ICES 2025 recommendation for blue whiting is 1,447 thousand tonnes, which represents a 5.4% decrease from the recommendation for 2024.

In 2025 Bakkafrost expects similar production volumes of fishmeal and fish oil as in 2025.

Bakkafrost expects the feed production at Havsbrún to be around 150,000 tonnes in 2025. Close to all of this will be sold internally to Bakkafrost’s Faroese and Scottish Farming segments.

Investments

On the Capital Markets Day on 17-18 June 2025, Bakkafrost announced a 5.0bn DKK investment plan for 2026-2030. The main purpose is to improve efficiency, reduce biological risk and enable continued sustainable growth in the Faroe Islands and Scotland.

The investments in the Faroe Islands will increase the annual smolt production capacity to 24.4 million smolt of 500g. The feed production capacity and flexibility are also increased to further improve R&D capabilities and meet the growing demand for feed as harvest volumes increase in the Faroe Islands and Scotland. Also, investments in new farming sites and new farming technology are included, as well as investments to improve harvest capacity and flexibility with Live Fish Holding Tanks.

In Scotland, planned investments include site expansions and optimisation as well as building a new harvest and processing facility to accommodate the growing harvest volume.

As a shared service to the Group, the investment plan includes building 2 new dual-freshwater treatment vessels in the FSV segment.

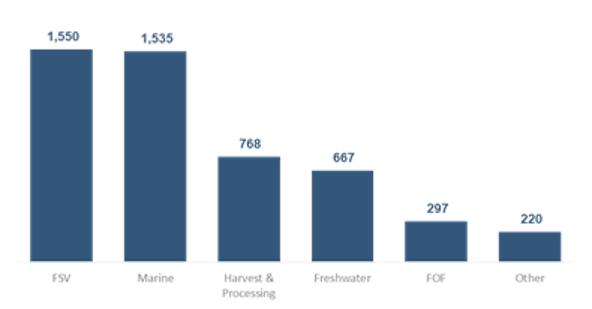

2026-2030 Investment programme per category (DKK 1,000)

Incorporated into the investment plan is also 245mDKK earmarked to energy transition, spread across the value chain.

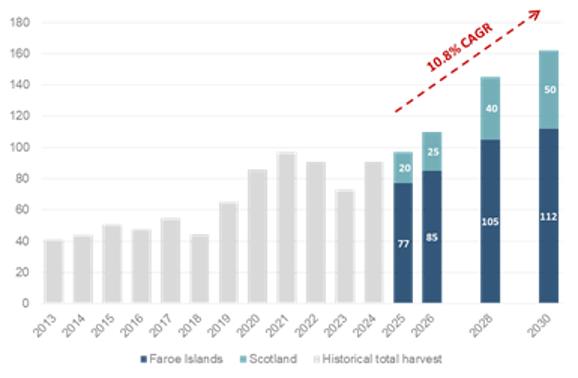

With the investment plan, Bakkafrost expects to sustainably grow the total annual harvest volumes to 162,000 tonnes in 2030.

Harvest volume (kilotonnes)

Since the announcement of the 2026-2030 investment plan on the CMD in 2025, Bakkafrost has decided to let some of the investments planned for 2025 rollover into 2026 due to the weak market outlook for 2025. Consequently, the timing of other investments in the announced 2026-2030 plan have been adjusted.

Updated 2026-2030 5.0bn DKK Investment programme vs. historical investments (DKK 1,000)

Financial

The global salmon product market's long-term balance is likely to favour Bakkafrost. Bakkafrost has a long value chain and a cost-efficient production of high-quality salmon products and will likely maintain financial flexibility going forward.

In March 2022, Bakkafrost secured a 700 mEUR sustainability-linked credit facility (expandable by 150 mEUR) with a 5-year term and 2-year extension options which have been executed. This facility, along with Bakkafrost's strong equity ratio, bolsters the Group's financial strength for organic growth and cost reduction in Scotland, while also facilitating M&A and future organic growth opportunities, and upholding an unchanged dividend policy.

Please find the Company’s Q2 2025 report and the Q2 2025 presentation enclosed.

Contacts:

· Regin Jacobsen, CEO of P/F Bakkafrost: +298 235001 (mobile)

· Høgni Dahl Jakobsen, CFO of P/F Bakkafrost: +298 235060 (mobile)

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

About Bakkafrost:

Bakkafrost is the largest salmon farmer in the Faroe Islands and the second-largest salmon farmer in Scotland. The Group is fully integrated from feed production to smolt, farming, VAP and sales. The Group has production of fishmeal, fish oil and salmon feed in the Faroe Islands and primary and secondary processing in the Faroe Islands, Scotland and Denmark. The Group operates sea farming and broodstock operations in both the Faroe Islands and Scotland. The Group has built a biogas plant in the Faroe Islands. The headquarter is located in the Faroe Islands, and the Group has sales and administration offices in Grimsby (UK), Edinburgh (Scotland), Boulogne-Sur-Mer (France), New Jersey (US) and Munkebo (DK). The Bakkafrost Group has 1,686 employees (full-time equivalents).

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities. The securities referred to herein may not be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended. Copies of this announcement are not being made and may not be distributed or sent into the United States, Australia, Canada or Japan.