Operational EBIT of DKK 1,004 Million for the First Half of 2022

23.08.2022

(Figures in parenthesis refer to the same period last year unless otherwise specified)

The Bakkafrost Group delivered a total operating EBIT of DKK 587 million (DKK 407 million) in Q2 2022 and made a profit of DKK 845 million (DKK 428 million). The combined FO farming and VAP segments made an operational EBIT of DKK 509 million (DKK 348 million). The FO farming segment made an operational EBIT of DKK 617 million (DKK 343 million). The SCT farming segment made an operational EBIT of DKK 41 million (DKK 53 million). The VAP segment made an operational EBIT of DKK -108 million (DKK 5 million). The EBITDA for the FOF segment was DKK 119 million (DKK 57 million).

Commenting on the result, CEO Regin Jacobsen said:

“We are satisfied with the results in this quarter. We are especially pleased with the strong biological performance in the Faroe Islands, where we had the lowest sea lice levels for 8 years, low mortality rates, and strong growth. We have also made significant advancements in our large smolt strategy, learning from our experience’s past year. Adjustments to the large smolt production have led to further improved smolt quality and robustness.

The farming operation in Scotland has improved compared to previous quarters, but we have had some challenges in one area in this quarter. Our investments in new hatcheries for the production of large and high-quality smolt is the key to transforming the operation in Scotland and we are well on our way with the first of the new hatcheries at Applecross, significantly increasing smolt production capacity in 2023.

The salmon market in this quarter has been marked by all-time high prices. We have seen strong post-Covid come-back from the Horeca-market while the global supply has decreased by more than 6% in two consecutive quarters. The supply of fresh salmon to the spot market has been further constricted by high contract share levels in the industry. In combination with strong demand, this has led to all-time high salmon prices. For the next year at least, supply growth will be low, and we expect moderately strong prices.

The salmon industry is also affected by the current strong inflation on raw materials and energy. Due to the long production time, there is a significant time lag before the increased costs will be fully visible in the financials of the salmon farming companies.“

Total harvested volumes for Q2 2022 were 19,700 tonnes gutted weight (28,200 tgw):

- FO: 13,100 tgw (17,600 tgw),

- SCT: 6,600 tgw (10,600 tgw).

Total harvested volumes for H1 2022 were 41,200 tonnes gutted weight (49,200 tgw):

- FO: 30,600 tgw (31,600 tgw),

- SCT: 10,600 tgw (17,600 tgw).

In total, 6.2 million (5.2 million) smolts were transferred during Q2 2022:

- FO: 3.3 million (3.2 million),

- SCT: 2.8 million (2.1 million).

In total, 10.4 million (9.3 million) smolts were transferred during H1 2022:

- FO: 5.3 million (5.6 million),

- SCT: 5.1 million (3.7 million).

The combined FO farming and VAP segments made an operational EBIT of DKK 509 million (DKK 348 million) in Q2 2022. The operational EBIT per kg in Q2 2022 was DKK 38.85 (DKK 19.84), corresponding to NOK 52.28 (NOK 26.93). The FO Farming segment achieved higher prices in Q2 2022 than in Q2 2021. For H1 2022, the combined FO farming and VAP segments made an operational EBIT of DKK 951 million (DKK 567 million).

The SCT farming segment made an operational EBIT of DKK 41 million (DKK 53 million). In Q2 2022, the SCT farming segment had incident-based costs of DKK 57 million (DKK 7 million). For H1 2022, the operational EBIT was DKK -12 million (DKK 46 million).

The FOF segment made a 23% (17%) EBITDA margin. Sales of fish feed amounted to 31,200 tonnes (27,300 tonnes) in Q2 2022. During Q2 2022, Havsbrún sourced 97,600 tonnes (59,300 tonnes) of raw material. For H1 2022, the EBITDA was 21% (16%). During H1 2022, Havsbrún sourced 175,600 tonnes (107,800 tonnes) of raw material.

The net interest-bearing debt amounted to DKK 2,267 million at the end of Q2 2022, compared to DKK 2,126 million at year-end 2021. Undrawn credit facilities amounted to DKK 2,924 million at the end of Q2 2022.

Bakkafrost aims at giving the shareholders a competitive return on their investment, both through payments of dividends and by value growth of the equity through positive operations.

The long-term goal of the Board of Directors is that 30-50% of earnings per share shall be paid out as a dividend. The financial position of Bakkafrost is strong, with a solid balance sheet, a competitive operation, and available credit facilities.

The Annual General Meeting, convened on April 29th 2022, decided to pay out a dividend of DKK 5.14, corresponding to NOK 6.70 per share. The total dividend of DKK 304 million (NOK 396 million) was paid out on May 20th 2022.

The equity ratio was 65% on June 30th 2022, compared to 64% at the end of 2021.

OUTLOOK

Market

Supply decrease of 7%

The supply of salmon decreased 6.8% in Q2 2022, compared to Q2 2021 incl. inventory movements. Without inventory movements, the supply was 2.8% lower, according to the latest estimate from Kontali Analyse.

70% higher salmon prices

Salmon spot prices were 70% higher in this quarter compared to Q2 2021. Reduced supply, exceptional high contract share in the market, general inflation on food, and continued strong demand for salmon have pushed salmon prices to an all-time high level in this quarter.

Negative growth in 2022

In H1 2022, the global supply growth of Atlantic salmon was negative at around 6%, compared to H1 2021. In H2 2022, the global supply growth is expected to be around 2%. For the full year of 2022, the supply is expected to decrease by around 1%, compared to 2021, including inventory movements, while the market supply of salmon in H1 2023 is expected to grow around 3%.

Bakkafrost has a strong focus on ensuring a well-balanced flow to the different markets to increase diversification and mitigate market risk. Bakkafrost operates in the main salmon markets, Europe, the USA, and the Far East. Since the beginning of the war in Ukraine, Bakkafrost has stopped all trading with Russia.

Farming

The strong biological performance in the Faroese farming operation seen in previous quarters has continued also in this quarter. Sea lice levels have been all-time low - the lowest in this quarter, compared to the same quarter previous 8 years. The low mortality rates have also continued in this quarter.

In Q3 2022, Bakkafrost will receive the new wellboat, Bakkafossur. The wellboat has a 7,000m3 tank capacity for seawater, 3,000m3 for freshwater, and a reverse osmosis system onboard for freshwater generation. This will strengthen Bakkafrost's capabilities to maintain low biological risk in the Faroe Islands.

The expansions of the hatcheries at Glyvradal and Norðtoftir are progressing well and will start operation in Q1/23. These are important milestones to fulfill Bakkafrost's goal to build an annual smolt production capacity in the Faroe Islands of over 23 million smolts of 500g in 2026. Further operational adjustments and fine-tuning have been made in the smolt production, based on the accumulated experience with large smolt. These adjustments aim to further improve the robustness and biological performance of the large smolt.

In Scotland, there have been some challenges in one farming area, but not as severe as in previous quarters. This demonstrates that the biological risks are still high. Bakkafrosts strategy to implement large smolt in Scotland is key to reducing the biological risk and improving biological performance. Building hatchery capacity in Scotland is, therefore, the topmost priority for Bakkafrost. The ongoing expansion of the Applecross hatchery is progressing well and will reach an important milestone by the end of this year when the 4th expansion phase is expected to be completed. This enables Bakkafrost to significantly improve the quality and increase the size of the smolt. During 2023 the Applecross hatchery will ramp up production to around 8 million smolts at 250g, the full capacity will be in operation in mid-2024 with an additional 40% capacity increase.

In Q2 2022 the average weight of released smolt in Scotland was 101g, which is 32% higher than in Q2 2021.

New hatcheries in Scotland will increase the total production capacity up to around 18 million smolts of around 500g in 2026. During Q1 2022, Bakkafrost secured the land for the construction of the second large hatchery in Scotland. Depending on the final surveys, the construction of the next large hatchery is expected to commence in H2 2022.

Having large smolt in Scotland is vital to transform the farming operation and reduce the biological risk in Scotland. It will however take time for Bakkafrost to materialise as it takes time to build the necessary hatchery capacity.

In Q2 2022, Bakkafrost upscaled the freshwater treatment capacity in Scotland with the introduction of the second wellboat with freshwater treatment capacity. This more than doubled Bakkafrost's freshwater treatment capacity in Scotland, which is an important measure for mitigating biological risk and reducing mortality.

Smolt release

Bakkafrost expects to release around 14.9 million large smolts in 2022 in the Faroe Islands and around 10.8 million smolts of around 120g in Scotland. The number and the average weight of smolts released are key elements in predicting Bakkafrost's future production.

Million smolt released | 2022 | 2021 | 2020 | 2019 | 2018 |

FO | 14.9 | 14.4 | 14.3 | 12.7 | 12.6 |

SCT | 10.8 | 11.1 | 10.4 | 12.4 | 8.6 |

Harvest volumes for 2022 in the Faroe Islands are expected to reach 68,000 tonnes gutted weight and 35,000 tonnes gutted weight in Scotland, giving a total of 103,000 tonnes gutted weight.

The estimates for harvest volumes and smolt releases in both geographies are dependent on biological development.

VAP (Value Added Products)

Bakkafrost's highly flexible value chain includes a state-of-the-art VAP factory with high capacity. This enables Bakkafrost to adapt well to the rapidly changing market situations.

Bakkafrost's long-term strategy is to sell around 40% of the harvested volumes of salmon as VAP products on contracts. The contracts are at fixed prices with a duration of between 6 to 12 months.

For 2022 Bakkafrost has signed contracts covering around 32% of the expected harvest volumes in the Faroe Islands and Scotland combined.

FOF (Fishmeal, oil, and feed)

The outlook for the production of fishmeal and fish oil is dependent on the availability of raw materials.

The ICES 2022 recommendation for blue whiting is 753 thousand tonnes, which is a 19% reduction from the recommendation for 2021.

Bakkafrost expects the production volumes of fishmeal and fish oil in 2022 to be higher than in 2021.

Havsbrún's sales of fish feed in 2022 is expected to be around 130,000 tonnes.

The major market for Havsbrún's fish feed is the local Faroese market, primarily Bakkafrost FO's internal use of fish feed, and the feed used in the Scottish farming operation.

Lately, the prices of vegetable raw materials have increased significantly. This affects the whole animal protein market as well as other food producers. Bakkafrost is in a relatively good competitive position due to the low inclusion of vegetable ingredients in the feed combined with a low feed conversion ratio and good access to marine raw materials.

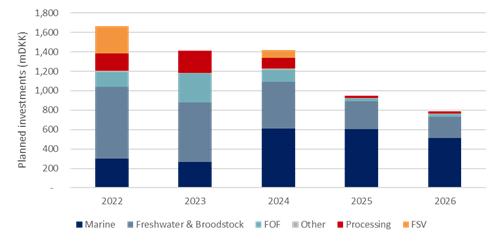

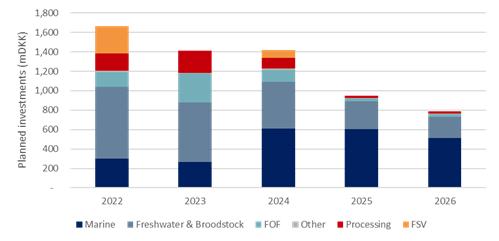

Investments

On the Capital Markets Day on 14-15 September 2021, Bakkafrost announced a 6.2bn DKK investment plan for 2022-2026. The investments will enable the transformation of the operation in Scotland and

provide sustainable growth in the Faroe Islands as well as Scotland.

The main purpose of the investments in Scotland is to replicate Bakkafrost's successful operation in the Faroe Islands. Bakkafrost will build 3 large energy-efficient hatcheries in Scotland, enabling the implementation of Bakkafrost's large smolt strategy and giving an annual production capacity above 18 million smolt at 500g. Having large smolt in Scotland will transform the performance, lower the biological risk and increase harvest volumes. In addition to building hatchery capacity, Bakkafrost plans to build a new processing plant to strengthen processing capabilities and Bakkafrost will also invest in more treatment vessel capacity to improve mitigation of biological risk. Further, Bakkafrost will make investments in marine site development.

The investments in the Faroe Islands include increasing annual hatchery production capacity to above 23 million smolts at 500g, investments in a broodstock facility, and expansion of feed production capacity.

With the investment plan, Bakkafrost expects to sustainably grow total annual harvest volumes to 150,000 tonnes in 2026. Over the same period, the total annual production capacity in Bakkafrost's value chain will reach 180,000 tonnes gutted weight.

6.2bn DKK Investment program 2022-2026

Financial

The long-term market balance in the global market for salmon products will most likely remain favorable for Bakkafrost. Bakkafrost has a long value chain and a cost-efficient production of high-quality salmon products and will likely maintain financial flexibility going forward.

In March 2022, Bakkafrost finalized a new sustainability-linked 700 mEUR multicurrency revolving credit facility agreement with an additional accordion option of 150 mEUR. The facility has a tenor of five years. In combination with Bakkafrost's high equity ratio, the facility gives the necessary financial strength and flexibility for the Group's investment plans aimed at significant organic growth and structural cost reductions in Scotland. It will also enable M&A's and further organic growth opportunities as well as support an unchanged dividend policy in the future.

Please find the Company’s Q2 2021 report and the Q2 2021 presentation enclosed.

Contacts:

Regin Jacobsen, CEO of P/F Bakkafrost: +298 235001 (mobile)

Høgni Dahl Jakobsen, CFO of P/F Bakkafrost: +298 235060 (mobile)

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

About Bakkafrost:

Bakkafrost is the largest salmon farmer in the Faroe Islands and the second largest salmon farmer in Scotland. The Group is fully integrated from feed production to smolt, farming, VAP and sales. The Group has production of fishmeal, fish oil and salmon feed in Fuglafjørður (Faroe Islands). The Group has primary processing in Glyvrar and Vágur (Faroe Islands), and secondary processing (VAP) in Glyvrar (Faroe Islands). The Group operates sea farming in Norðoyggjar, Eysturoy, Streymoy and Suðuroy (Faroe Islands) and in Scotland. The Group has broodstock operations in Streymoy and Sandoy (Faroe Islands) and in Scotland. The Group has a biogas plant in Streymoy (Faroe Islands). The headquarter is located in Glyvrar (Faroe Islands) and has sales and administration offices in Grimsby (UK), Edinburgh (Scotland) and in New Jersey (US). The Bakkafrost Group has 1,699 employees (full-time equivalents).

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities. The securities referred to herein may not be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended. Copies of this announcement are not being made and may not be distributed or sent into the United States, Australia, Canada or Japan.